My most popular blog post so far has been my experience with T-Mobile. It was a horrible experience and I wanted to share with others so they could use the same channels I used to resolve a bad situation. This brings us to today, when I received an email from Capital One 360 that an automatic ACH payment was processed out of my checking account. This was strange because I’ve been transitioning from Capital One to another bank so I wasn’t expecting any payments to be processed.

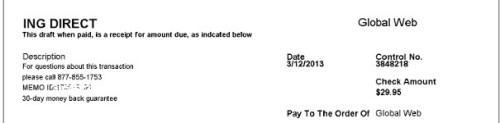

When I logged into the site, I was informed that there was a ‘Biller Initiated check Payment’ from a company named Global Web for $29.95. I immediately called Capital One to get more information on the translation. I spoke with a representative named Michael who said he’d open up a ticket but didn’t have any additional information (In truth, he wasn’t very helpful). He said I should call back in two business days to see if they had any additional information.

The next thing I did was to google in the information at hand. This led me to http://whocallsme.com/Phone-Number.aspx/8778551753 which showed I wasn’t the only victim in this scam and it could have originated at Everhome Mortgage.

A short time later, an email showed up in my Capital One 360 inbox with a copy of the check (which was already available) and a phone number to call if I needed additional assistance. I immediately called the number and spoke to Liz who was much more knowledgeable about the situation than Michael. She walked me though what would need to happen to get the charges reversed and said she would email me the form ‘Sight Draft Affidavit of Unauthorized Check’ which I would need to fill out and mail or fax to their office in order to get the charge reversed.

Eventually, my curiosity led me to call the number on the check. After waiting on hold for a few minutes, I was connected to ‘Mike’ at extension 7546. He denied that it was fraud, but was able to tell me that he worked for an intermediary and the charge was from an adult web site at 4:10pm on 3/12. This was especially interesting since I was at work during this time projecting in a large conference room. What was also interesting is that ‘Mike’ couldn’t tell me specifics on the charge (i.e. company, url, etc.). Mike was a champ in that he mentioned that his company was an intermediary and was based in the Dominican Republic. Again, he wouldn’t give out specific details but said he would stop future withdrawals (apparently this is now a subscription charge).

At this time, Capital One has emailed me a Sight Draft Affidavit of Unauthorized Check. The plan is to fill it out and fax it in first thing in the morning. This should allow Capital One to reverse the unauthorized charge. I’m also going to get a new account number so this doesn’t happen in the future. If they can’t do this, I plan on moving all my assets to another bank.

UPDATE (3/14) – I faxed my Affidavit of Unauthorized Check. The charge has been reversed (I assume through Global Web). Also, Everhome Mortgage called directly as they had seen the blog post and researched the issue and didn’t have any data breaches on their end. The likelihood is that it could have been a coincidence that a few people had them as their mortgage processor. I feel better having talked to them but I’m still not ruling them out because I had recently changed my ACH on their website.

UPDATE (3/25) – I have now been credited twice. Capital One 360 reversed the charge yesterday. I’m guessing this is due to me faxing in the Sight Draft. Also, a Capital One rep named Tasha has been trying to get in touch with me. We’re on day two of phone tag. One additional note… this fraud seems very popular due to all the comments and traffic. This post is getting anywhere from 50-100 hits a day. I encourage everyone to follow-up with their bank and I appreciate all the comments.

UPDATE (3/28) – Michael from Capital One called and let me know they are aware of the issue and it’s isolated only to me. They are changing my account number, which is good. Michael is supposed to call me back to confirm when this is done.

UPDATE (4/7) – I’ve published a summary of everything that has happened and potential actions if this happened to you.

If you’ve ever had fraud on your checking account or have any similar experiences, please feel free to drop a note in the comments.

As I write this, I am literally on hold with my bank to try to get the exact same fraudulent transaction reversed.

My mortgage company is also Everhome Mortgage. This is the first month that my mortgage payment was to be automatically deducted from my bank account.

Shady shady shady.

Best of luck getting it resolved. Please leave a note in the comments if you find out any information.

Former Everhome Mortgage customer, same issue only the account had been inactive for 4 years without a single transaction, no cards or checks.. We used this account to pay our mortgage years ago and only found out about the charge do to overdraft fees, we thought the account was closed.

I am glad you posted this. Saw a strange bank draft and took it to my bank and the charge is being reversed. Had to open a new account with them but it was worth it. Thank you! It’s a scary thought that someone has your info.

I am in the exact same situation. I also have a mortgage with Everhome. Interesting. I also have a Capital One 360 account that my mortgage from Everhome drafts from monthly. The only difference is the company name is: Web Entertainment. The fact that there is such a thing as “Biller Initiated” drafts is very disturbing. I am going to fax the “Affidavit of Unauthorized Check” asap.

This happened to me on 3/13/13. Luckily my husband and I aggressively monitor our bank accounts. We also have Everhome mortgage and ING newly changed to Capital One 360. My husband contacted the number on the transaction and got the same lack of info. No details on the business taking my money….They claim to be a “biller for a variety of internet businesses.” They offered to cancel the payment which was for an adult website. Got a confirmation number but I still don’t trust them. The purchase was made at 11:40 PM when I was knocked out in Sandman Land. Unless there is a condition called *sleep-online surfing* this is bull.

Contacted Capital One 360 to put them on alert and to reverse the charges. We also informed them of a possible link between Everhome and Cap One 360 customers.

Same thing happened to me. Global Web, $29.95, posted 3/15. When I called the number on the check I got the same story. Intermediary processing company. They agreed to reverse the charge, but could take up to 4 weeks. I immediately called my bank (M&I Bank) to freeze my account until this is cleared up. Interesting that I too have a CapOne 360 account, and the M&I account is linked to it. Mortgage with 5/3rd Bank. Scary that with just a routing and account number my funds are so easily accessible.

Same happened to me. It posted from Global Web, $29.95 on 02/19, and we have Everhome Mortgage as well.

Just had the same thing happen as well and my mortgage is with Everhome as well!!! Mine was Web Entertainment, for $29.95 and has the exact same number listed on the draft as well. Everhome clearly has a security breach!

I got the same problem today. Global web charged my Chase bank account without my permussion. We used to have Everhome mortgage account. They must have had somekind of website breach.

I too was charged a bank draft of 29.95 from global web I am on hold with bank trying to resolve issue however i have never had everhome mortgage nor am i associated with cap one 360 this must be a huge scam going on

My bank account was ‘robbed’ of $29.95 on 3/1/13. The only reason I caught it was that I happened to go online on 3/9 to check my balance. I able to view the bank draft online, and it is exactly as the one posted above. I called them, they said it was for an adult web site, which I don’t do, and even if I did I would never give them my banking account information. I asked if they showed a time, and she said 4:50 am. They said they would reverse this, which they did on 3/18. By the way, I’ve never done business with Evergreen, but I do have a Captial One credit card which I pay online with this bank account.

http://www.globalweb.net/members/fraud-alert/fraud-alert.asp

On 3/26,2013 at 3:12am I was charged an un-authorized amount of $29.95 by a fraudulent company called “Global Web”. I bank with PNC and immediately notified them. I currently opened a fraud investigation and will be filing a police report. I will be reimbursed any loses due to this scam and will close out this account at the conclusion of the investigation. I am not affiliated with Evergreen Mortgage or Capital One 360, but I too have a capital one credit card to which I had been paying online directly through my bank account for over a year. I don’t know if this is some how connected but the bank told me there are several ways for Global Web to get my bank information. Anyone that has your routing and account number which is so conveniently located at the bottom of checking account checks, deposit and withdrawl slips can apparently bill your account. My issue is why does the bank allow this without some sort of security question or confirmation from the payment receiver to insure that it really is “biller initiated”. I did however print the information from http://www.globalweb.net,corporate page and fraud alert link, as evidence of fraud to make both my claim to the bank and the police.

I had the exact same problem, but I think I’m getting the runaround from Capital One 360 on the affidavit. First they sent an “Affidavit of Unauthorized Use”, which appears to apply to the debit card. If you send that in your debit card will be shut down. Next, they sent a form called “Attempt to Resolve a Dispute” which doesn’t seem to apply to this either. Is it possible to email or post a link to the “Affidavit of Unauthorized Check” form? Capital One seems a little clueless about this.

Got an email from Capital One’s investigations team today. Suspicious…called in through the main number for account service. Turns out they want to open new accounts for any C1 360 account that was affected. It’s a real pain having to lose access to the account for a week while the new debit cards ship and then having to set up direct deposits again!!

Sadly I’m joining the rest of you. Discovered a strange check number on my bank account activity……it’s Global Web, and when I called told the same thing you all have been told. Supposedly I will see the charge come off within a week, we’ll see. Meanwhile, the “billing company” I called who’s number was on the front of their “check” actually urged me to call my financial institution and give them the IP number they have listed for this transaction. I will call first thing in the morning but let me add something very disturbing……I TOO have my mortgage thru EVERHOME. Scary!

Mark first of all thank you for posting this.

It can’t be a coincidence, this just happened to me yesterday. 29.95 from global web, for a adult web site. I also have Everhome Mortgage. Now, I’m furious. I mail in paper checks though. Only 2 times last year did I pay online.

I had to close my chase acct, I feel anxious now that nothing is safe.Not online banking or paper checks. The guy at Chase kept making me feel like I gave someone permission to use my acct. I was furious inside, as I kept insisting there is no one.This is a fraud situation! He didn’t think it was a big deal since I would be recouping the money. And these situations happen everyday!.

I also contacted the phone number on the transaction, and this girl couldn’t have cared less. She kept saying she was only the valdiator for the 3rd party company. I asked her if she was responsible for validating the purchase I didn’t make to my acct. When I asked her who to contact she said the company is in New Zealand!!

I just called Everhome, but it is after hours, they are closed I left a message with their answering service. I’m sure it won’t be productive. It is infuriating that these people that do this are allowed to get away with this. It doesn’t matter if it’s for a dollar or thousands of dollars!. Our security is gone.

Ditto on many of the above:

*same date 3-15-13, *Everhome,* 29.95,* Auckland,New Zealand adult company supposedly at* 4:00a.m.. I spoke with “Alex” at the billing center in Minneapolis last night and got nasty and demanding. A fake e-mail had been created and was listed as justification for the charge. Everhome will be my next call. Any advise?

Thanks for posting! I have had the same experience. My account was charged $29.95 by Global Web. I have filed a fraudulent claim with my bank. It’s scary because my mortgage is with Everhome and I have an account with Capital One 360. The rep said that my account should be reversed within 5 business days.

Same here is $29.95 to global web with Everhome as a mortgage company. The fraud was to a wells fargo account. Seems that everhome is the commin link, they will be getting my call tomorrow and paper checks from now on.

Add me to the list. Also have a mortgage with Everhome.

Add me as well. My mortgage is with Everhome also. Please update the rest of us if anyone finds out whether this is a recurring charge or a one-time scam. Everhome clearly has a security vulnerability that someone has exploited!

I called Everhome and the customer service rep said they use a third party company for their automatic drafting and there has been “something going on” …… She has been getting lots of calls like mine!!

I used to have a mortgage with EverHome Mortgage last year. Just got hit with this charge as well.

Do you know who EverHome uses for a payment processor?

I have no idea. Might be best to give them a call at 800.669.9721.

I also have Everhome Mortgage, got hit on the 15th of March for $29.95 for Global Web, then again last night from World entertainment for another $29.95 on a different back account. I had both of these accounts stored with Everhome. Both charges are in my ex husband’s name and he is not on either account but is on my mortgage with Everhome. Tomorrow will be the fifth business day since I reported this and I don’t have a credit yet, but Everhome is definitely a common thread.

Same story here. I just got refinanced out of Everhome Mortgage at the end of February, but also got the 3/14 “Global One” charge for $29.95. I happen to also use Everbank for my account and they contacted me regarding the charge so they are already on top of it…but still more than a coincidence that everyone has them as their processor.

Charge was reversed. No thanks to CAPITAL ONE 360; they want customers to file a NOTARIZED affidavit which means more money out of your pocket to get your stolen money back. Boy, do I miss ING…they never put us through all the changes when there was a security breach.

Same thing happened to me last night, a charge of $29.95 at 11:45 while I was sleeping. I also have Everhome mortgage.

I just noticed the same $29.95 charge to my checking account via e-check, but from a company called World Entertainment. Phone #: 877-211-1744. I called this number and the representative stated the charge was for an adult website subscription. I told him that I did not initiate such a charge…refund to follow in a few days (I hope).

Noticed $29.95 fraudulent charge from Global Web. I also have everhome mortgage auto-draft.

I too got the same charge from global web and pay my mortgage to everhome mortgage online. I am concerned as to why Everhome has not notified their customers of this because they are obviously aware of the problem. Had they notified their customers we could have notified our bank BEFORE the charge came through.

Add my name to the list – $29.95 taken out of my bank acct. Yes, I had a mtg with Everhome and that was the amt pd every month for flood ins escrow. Everhome must have a security breach!

I was just hit with the $29.95 charge to my checking account from World Entertainment. Same situation as GL poster above. I was assured by the ‘billing verification’ person who answered that I would be refunded. I do not have a mortgage with Everhome and have, incidentally, never even heard of the company.

I also was hit with a $29.95 charge from World Entertainment….on 3/19/13…i woke to check my bank acct only to find that this company has stole money…the number on the ck was 877-211-1744..which i promptly called the next morning (3/20/13) and was to they would “reverse” the charge and it would take 3 to 5 business days to show on my acct…i will post when i finally (hope?) to get my money back…i also have Everhome for my mortgage and i pay online…

I too, was also charged 29.95 from global one; however i am not familiar with the mortgage company that everyone else seems to have in common……My mortgage is through the VHDA………I did however have a automobile loan through fifth/third bank a few years ago………….

$ 29.95 from Global Web just hit my Chase Checking Account. I too had (no longer) an Everhome Mortage account. Have contacted State Attorney General’s Office.

I just called Everhome and they told me “we are aware of the situation and are researching it. IF YOU CURRENT HAVE AN EVERHOME MORTAGE or HAVE HAD ONE IN THE RECENT PAST, call Everhome and file a complaint and ask for a supervisor to call you back! Threaten them with lawyers and attorney general complaints.

CHECKING ACCOUNT DRAFT Fraud / Scam Scheme #1 – Feb/Mar 2013

If you have recently noticed an un-authorized charge on your checking account in the amount of $29.95, along with a description of the charge being made by “Global Web”, this charge is a fraudulent charge and was not made by our company.

Our company name is Global Web Solutions, Inc. and we are based in Mechanicsville, VA (just minutes outside of downtown Richmond, VA). We have been serving our customers for almost 17 years and have no method in our systems to auto-draft checking accounts. Nor do we have any item or service that we sell for $29.95.

What you need to do is the following:

Contact your bank and report this $29.95 transaction as a fraudulent charge, and ask your bank to open up a fraud investigation. Stress to your bank you are NOT an isolated case in this matter.

Contact your local police department and file a report on this fraudulent charge. Stress to your police department you are NOT an isolated case in this matter.

Provide to YOUR BANK / BANK’s fraud department the following information, and ask them to contact:

United States Secret Service

Phoenix Arizona Office

Agent Jenna Horton

Phone: 602-241-4319

Agent Horton and her team are actively investigating this latest fraud scheme and THEY NEED TO HEAR FROM YOUR BANK !!!

Interesting, because the number you show for “Jenna Horton” (Agent) shows on a query as belonging to 602-241-4319 : Dung Le, N 22nd Dr”

Are you part of the scam?

Same thing here. My wife calls and said there was a strange charge on our account for $29.95. I call the bank and get info that this was a phone draft transaction. they gave me the Memo id # and the phone number. I called the number and “Joe” answered the phone. He said it was for a subscription for an Audult entertainment site. I was furious as we were caring for our daughter during this time after surgery. Anyway, Joe said a refund would be issued in 3- 7 business days. I asked him how they got our information and he said maybe thru email address but that the bank draft had to have personal information in order to complete the transaction i.e. account number, routing number and name and address. anyway, he assured me that a refund would be posted to my account withing 3- 7 business days. Has anyone went to a web site fafsa.com instead of fafsa.org? me and my wife thought we were filling out our daughters FAFSA which we put all information ( social security numbers, Checking account numbers) only to find out it was with FAFSA.com instead of FAFSA.org. Our mortgage is thru a local bank so we are just looking for some connection.

I don’t usually comment on anything online but saw this after we had to change our bank account yesterday because of it. We got hit twice because our old local bank was bought out by another bank, Tri Counties, so the old acct number was riding under the new in the bank system. One charge was for Global One on the old acct. and right above it was Global Web on the new account number. We also have Everhome but do not have any Capital one accounts. Being a small town with a local bank everything was changed over within 45 min including the debit. I looked on the internet as soon as I saw the charges and took a copy of the fraud alert on the Global Web site to the bank with us. Our bank VP is sending it along with the report to the fraud dept and contacting the US Secret Service for us too.

Everyone commenting needs to call the FTC to report this

877-382-4357

This just happened to us for the second time in four months. When we first saw the $29.95 charge, we closed the first account, went through the charade of the fraud investigation and opened a new account. Today we saw a new $29.95 charge to World Entertainment with the same 877-211-1744 number. We too are Everhome customers, although not with Capitol One. We had to file a police report the first time, but I doubt anything happened. I’ve seen people suggest contacting the secret service. Do they do more than just go through the motions on this one? It seriously a lot of time wasted when the people who are supposed to be investigating it (the banks and the authorities) don’t really seem to care about finding the culprits.

Received a $29.95 charge from “Checking Withdrawal”. My bank (not Capital One) told me the charge was from World Entertainment 877-211-1744. The phone answered by a third party billing company who did not have the website, but promised a credit in 3 to 5 business days. Spoke to representatives at my bank and Everhome who are investigating.

Mine was from “Web Entertainment”. My bank, a small local one, caught it before I did and reversed the draft the next day.

I called the “3rd Party” processor (I don’t believe that part of the story either), and they stated that I subscribed to something from an adult website and gave me a day and time 2 days before the draft.

When I called my bank they said they’ve seen 5 the last few days, all with different payees but the same scam.

It’s disconcerting when you see your Routing and Account Number on the draft. It’s violating.

In case everyone is wonder, Everbank uses the same payment processing company as the other banks some of you have mentioned. That company is LENDER PROCESSING SERVICES, INC (LPS) who has most recently been in the news after receiving a massive federal fine for robo-signing foreclosures. It’s pretty clear now they are the source of this data compromise.

Received a $29.95 electronic check withdrawal from Global Web on my checking account at my credit union. Interestingly, the authorizing name on the transaction was my short name, not my full legal name. The only EFT program that I use that has my short name and not my full legal name is with Everhome mortgage. I contacted my credit union and will be going by there this afternoon to record the affidavit for a fraudulent transaction. I also called Everhome and they were aware that there is an issue and i’m supposed be receiving a call back from a Manager to explain to me the situation. Seems pretty obvious what the situation is to me as well as all the other posters here. My credit union said they will credit my account in 3-4 days.

This morning I discovered that a fraudulent charge of $29.95 was made to my Chase checking account by the same company. The check number was wierd and I have limited funds so watch my account closely. When I called the resolution department at Chase to dispute this charge, the guy there suggested I call the “877” number on the “check” image. I asked why he thought I’d be able to get satisfaction from someone who made a fraudulent charge against my account. (I’d already explained that I’d looked the number on the internet and had found numerous recent complaints that it was some sort of clearinghouse for internet porn sites.) I’ve never had an account or mortgage with Everbank but have received correspondence from “Lender Processing Services” after a short sale through Bank of America who bought out CountryWide. I asked why they couldn’t just block any future charges from this company and was told “that’s not how things work in the banking world” and suggested I close my count or he could put a hold on it (which means I won’t have access to my money either). In the end he said they would look into it and it might take 4-5 business days and suggested I still try to call the “877” number to see what I could find out. After leaving a scathing customer service survey, I called the number and a lady who sounded a little loopey explained that there had been another such call this morning and that she’d contact the company involved and tell them to stop making automatic withdrawals from my checking account. She said it would take 4-5 business days to have the charges reversed on their end. I guess we’ll see but in the meantime I plan to close my account with Chase due to their lack of concern about fraudulent charges — it makes no sense to me why they can’t just block the person trying to make this charge.

I hope others will post the results they get. Thanks for starting this blog.

I have a Chase account, and just saw this same check post to my account for $29.95 to Global Web. I have never had a mortgage through Everhome, which seems to be a common link for many on this thread What is interesting is the “Charge To ” name listed on the check is my ex husband, so I immediately thought he had done something fraudulent on my account. Now I wonder if it is just part of this larger scam. The number I called on the check said they are “Billing Solutions, LLP,” and they offered to reverse the charge with no hassle. Would love to know the source for the breach of information.

I too was charged 29.95 on March 29th. The company listed was Web World, but that’s not who is getting the money. The company or person that’s getting the money is out of New Zealand. The person even gave a fake email address in association with the “check”. The check looks exactly like the one at the top of this blog but with a little different information. I’m in Virginia but have never heard of Everhome. The “third party billing company” offered to give me a refund but it does look like I’ll have to close our checking account. FILE A REPORT! THE MORE THAT DO THE BETTER!

Found electronic check to my credit union account. Global Web for $29.95, finding this blog from phone number search. Haven’t filled out police report and closed/open accounts yet. Was making sure its fraud first.

Former Everhome mortgage holder, and just found a 29.95 Web World draft on my checking account

Not an Everhome mortgage holder. Used to have a Taylor, Bean, Whitaker / Cenlar mortgage but refinanced several years ago. Received notice of a $29.95 bank draft I supposedly initiated 3/27; I have not authorized ANY payments in that amount for several months. Info from my bank says the receiver was Global Web; never heard of them until I googled it here. Lucky for us, our bank “returned” the debit, even though there was money in the account to cover it. The bank is helping us erect an ACH firewall (for a one time fee).

Taylor, Bean, Whitaker / Cenlar also uses Lender Processing Services for payment processing.

On Monday, I saw there were TWO fraudulent transactions on my Capital One checking account. Posted 3/27/13, and 3/29/13. Both for $29.95 in the form of an electronic check. One was for Global Web, and one was for Web Entertainment. I do not have an Everhome Mortgage but I do pay my mortgage by electronic check to VHDA and perhaps they use the same processor. Either way, Capital One has not been that helpful so far. They are sending me some forms to sign and send back. When I called the number on the fraud checks, I was told the same thing everyone else was told above. They are a billing company (allegedly) and the subscription is for an internet adult website. Twenty years I have had this checking account, and I am going to have to close it. I am wondering if the breach is with the mortgage processor, or perhaps Capital One/ING.

I had the same charge from Global Web hit my bank account 3/18. I got the same response from them about the adult website charge. I had a mortgage company that uses LENDER PROCESSING SERVICES, INC (LPS) also. This seems to me to be the source of the breach. Though my bank, Compass, seems less than concerned with telling me how this happened. Everyone needs to fill out a police report, an FTC FRAUD REPORT, and of course make your bank issue you a new account number.

My 86 year old Mother was charged with a $29.95 checking bank draft charge from Global Web in late March. The name used was my deceiced son. My Mother is not up with internet times, she does not do anything online, so you can imagine her reaction. How they got my son’s name,tied to her checking account numbers, is a complete mistery. Wells Fargo should have caught this but didnt, even though i had my Mom add fraud protection to her account a couple of years ago. No connection to Everhome. The money was refunded…….but so what…….NO ONE IS SAFE. Best to get out of the system.

Same happened to me. It posted from World Entertainment for $29.95 on 03/29, and we have Everhome Mortgage as well. I bank with Chase and they recommend closing the account down and opening a new one as that is the only way to ensure they don’t keep drafting our account. I share in everyone’s frustration.

I woke up today to the same $29.95 charge on my account however mine was from “web world” i called them and they notified me that apparently at 5:02 am i subscribed to an “adult entertainment” website. They were not to helpful, i got the same “we will reverse the charge and any future charges” i did however get one thing from “Steve” an IP address….I am not sure if it is legal or if I have the right to post it….ironic I know….I traced the IP address back to Mt Vernon, NY….any advice from this point on? Also I am not nor have I ever been and Everhome Mortgage customer, if that helps anyone. Oddly enough the strangest thing is I use this account for one thing-direct deposit from my employer (which is not any of the companies listed so far) my deposit immediately gets swooped out and transferred to another account at the same bank….the only room for error is that my first account (the one receiving the direct deposit) is actually an account that my bank acquired by purchasing another bank (thats how i ended up with two checking accounts at one bank) however i did notice on the image of my check that the routing information entered was that of the previous bank (the one acquired by the bank i have now) and not the routing number of my current bank meaning the information this person had access too is about 6 years old or older…. sorry if that is confusing, simply i had checking accounts at bank a routing 222 and bank b 333 bank a bought out bank b so now they are both bank a, this was over 6 years ago. the check came thru with routing 333 but should have come thru as 222 since both accounts belong to bank a now and bank b routing 333 hasn’t existed for 6 years…sorry i tend to ramble…going to research this more-GOOD LUCK ALL!

Same thing happened to me as well. Got a $29.95 charge from Global Web on 3/25. Called Global Web and they said that the money would be refunded in 3-5 business days. Called the number again today and can’t get through. Called my bank this morning and they filed security report and are disputing the charge. I also have a mortgage with Everhome.

I too have been charged by this company. What is interesting is they wrote the check to draw on WASHINGTON MUTUAL Which was bought out by Chase during the banking meltdown. I spoke to Chase who is reversing the charges. GLOBAL WEB must have hacked Everhome Morgage. I pay my fathers morgage payment to Everhome. I tried the number which rang busy. Then it said it was a number not in service. If you have read any of these comments please post your experience. Congress should get some law in place to resolve these problems for all account holders when we have been made targets or victims.

Just think how many people who this has happened too, who are not aware of how to get their money returned to them. Theft is a crime.

The account that was charged for me was also a Washington mutual account, and it came threw with wamu routing, not chase however I don’t have any business with everhome mtg but I am reading that other mortgage companies are relatedto them, or atleast the payment portionof their site…

Thank you for providing information. My Account was charged 29.95 by World Entertainment on 3/25. I have Everhome online payment as well. I called Everhome just few minutes ago and I was told they are aware of this.

Thanks for the information…My checking acc’t got hit for $29.95 on 3/28 AND I’m an ex-Everhome Mrtg customer. I smell a rat!

Apparently they are also using the name Global One. The image on my statment was identical other than the heading read Global One instead of Global Web.

Wow! Thought I was alone in this. Same $29.95 charge to our account. We have Cenlar and Chase for two mortgages we have, which I only pay Cenlar online. Which one is to blame for the security breach?? This world has gone to hell. People stealing others hard earned money. Where do we go to pay our bills now, Mars! I was told to file a police report and close my bank account. I’m on it. These so called humans that are doing this are pathetic. I would much rather live with 2 legged furry friends in this world than 4 legged, Except for you all. Thanks for the post!

Cenlar also uses Lender Processing Services for payments. All of these mortgage companies even use the exact same default payment page provided by LPS.

Like this one.

https://www.loanadministration.com/loanadministration/ACCLogin.jsp

Looks like we are a new batch. I found older posts going back to 2011 with different 800 numbers but still Global and still 29.95. My bank contact said I was one of 9 at our credit union out of their 36000 customers just in the past few months. I read in a few forums that a common thread is everhome mortgage. I use them. But I also recently have had my chase card credit card # duplicated. Called the 877 #. Same story. more than willing to cancel and refund. Said it was for an adult website subscription. Tried to scare me into not calling my bank by saying it was illegal to get a refund on each end. Really, treating me like im the crook. As far as everhome goes, they have my ach info for occasional payments. But, my monthly payment actually is taken out by Equity Accelerator. This is a 3rd party who works with everhome to process my payments bi weekly.

Same Here! Recently Charged by Global Web 29.95. Everhome and ING customer!

Same story line as above. ING/Capital One and Everhome Mortgage customer and a mysterious $29.95 draft to my bank account from World Entertainment on 3/26 with the same story line when you call the 877 number on the draft my bank said the folks said it was an adult website.

ditto. Everhome Mortgage. $29.95 Will be making calls tp Everhome, police etc tomorrow

It is not just those who have mortgages who are getting scammed. I got the charge to my checking account 4/2, for 29.95 and to a Global One, and I do not have a mortgage … I rent. I do, however, pay most of my bills online, and the previous weekend, had done so … maybe that is where my account information was stolen in cyberspace. I have opened a new checking account, called the 877 number (was told I would be refunded in 3-15 business days), and filed a dispute with my bank, so I still have my old account open simply to receive this refund (and my bank, TD Bank, promised to issue a refund regardless of the outcome of their investigation, in 10 business days). The lady at my bank admitted that any bank is partly responsible, since all banks must approve any debits/charges to any account; they do not just come in automatically to an account. So, if you are a victim too, your bank’s fraud department definitely needs to be alerted.

P.S. I just called Agent Horton’s phone number with the US Secret Service office in Phoenix, Arizona (602-241-4319). Due to the volume of calls she is getting, it goes right to her voice mail. Per her message, you may leave your name and phone number and state where you are calling from, and she will add your name to the victims’ list. Anyone who has posted here, I encourage you to call her number, because it will help her track how far this is spreading and how quickly.

And, Mark, thank you so much for sharing your story and soliciting all these comments.

I am so glad I came across this. I just got off the phone with Chase Bank’s Fraud department. I too had a $29.95 charge on 3/19 from Global One. I also have an Everhome mortgage. I will contact Agent Horton now. Beware, at this time, Chase is not looking further into this. I called them back to give Agent Horton’s info and they just said they would pass my concern on to the “powers that be” but did not take her information. (Which translates to probably not going to do anything)

Thank you again for starting this and mentioning Everhome!

Also had an Everhome mortgage until last year that was autodraft. Thank you for the post. My first call to Capital One was not productive and I was told to call the number on the check, which is also a bogus number. Fraudulent charge was made 3/29. I just caught on statement review.

This fraud is ongoing…. Global Web draft for $29.95 dated 3/26. Contacted my bank (Fifth Third) to resolve this fraud. The account hit is the one I use to pay credit cards and an automobile loan…

You folks do realize that these “scammers” can put anything on the draft…it could have been IBM, or Apple, or Capital One; but no, these “scammers” are using our good name, Global Web….we are actually Global Web Solutions, Inc. – and WE are not the ones taking your money. We have had a fraud alert up on our website for 2 years. We have all the appropriate contact information for Agent Horton with the United States Secret Service (as posted above). Notice how NONE of these comments state that they actually called Global Web Solutions, Inc. and we told them of the fraud and how to handle this.

Are you also Global One? And… How are we suppose to call you? It doesn’t have your contact information in our information. If this is true these are scammers it sounds like your anger should be directed towards them and not us as victims. If you search either Global Web or Global One you will see several companies. Not just yours.

Same charge happened to us on 4/2. Since I use e-checking on an occasion, I had to wait for a copy to find out the recipient and make sure it wasn’t legitimate. I just reported it with my bank. Yes, we had Everhome in the past as well.

I have a EverHome Morgage on my home. On March 25, 2013 Global Web inter my checking account without my authorization and drafted a check for $29.95 that overdraft my checking account. I am out of $60.95. I called the number that my bank gave me for this Global Web. They stated that my money would be back in my account in 3 to 5 days. That was thirty days ago I have still not seen my money. What can we do to stop this and get are money back?

I was draft was on 3/5 for $29;95 and I finally got my credit yesterday..

Same thing happened to me. I have Everhome. I’m extremely disappointed as this has happened to be before – a year ago and I believed it to be Everhome last time. They wanted me to fill out a police report and this and that, but I simplified it and called my bank, had them reverse the charges and closed the account. It happened again this month with the new account and the only place I put bank account info (account number and routing info) is when I pay my mortgage. I really think Everhome has a serious security problem that has gone on for quite some time. I will go great lengths to ensure I never again have a mortgage through them.

I was also hit with this charge from global web and I have Everhome. I did some research and Here is a link to there Facebook page using the same number that was on the check. https://www.facebook.com/pages/Global-Web/513527138685823 I have left a few messages about the fraud but they just remove it. Here is also a word press page they have http://globweb1.wordpress.com/ I find it funny that when you call they say they are a 3rd party and not global web but there # is tied to both of the above global web sights above.

I also had a mortgage with CENLAR (who took over after the failure of Taylor, Bean and Whitaker). However, I refinanced a few months ago. The scam details changed slightly in my case. Still $29.95, but the bogus company is now called “Web Services” instead of “Global Web” and the 800 number is different. Waiting to see if my bank will cover this or not. If not, then “bye, bye.”

Got hit by World Entertainment in the amount of 29.95 on March 28th. Have mortgage with Chase, not sure where the breach was? Called the 3rd party billing company, Billing Solutions, and they gave me a confirmation number and told me that my account would be credited in 3 to 5 business days. Guess what, I’m still waiting! Call them back and they tell me that their is a delay with the bank in which World Entertainment uses and it should be credited by May 15th. These bastards need to be stopped, wheres the media when it comes to this type of crap!

Happened to me. Ugh! On the phone with the bank now. They are called WEB WORLD now so be warned! I did just called Agent Horton’s phone number with the US Secret Service office in Phoenix, Arizona (602-241-4319). Due to the volume of calls she is getting, it goes right to her voice mail. Per her message, you may leave your name and phone number and state where you are calling from, and she will add your name to the victims’ list. Anyone who has posted here, I encourage you to call her number, because it will help her track how far this is spreading and how quickly. I can’t believe this. We just got a car and have been using a Company called Ally with JPMorgan Chase Bank. As soon as we made our first mortgage payment, the 29.95 charge was made the very next day. I don’t really know what to do about my car payment now. I’m going to close this account and get a new one, but does that mean that when I make a payment, this will happen again?

I meant car payment, not mortgage.

We also have been charged, We had Everhome Mortgage, We still have not got our refund yet and it’s been a month. I called the number on our bank draft and they gave me the IP# and it says its from Organ. And an email from the person but it does not make since, This person needs to be in jail!!!!!!!

Global Web also told me it was from an adult site. And they were not helpful at all,They act like it was are fault.

Same here, and also an Everhome Mortgage customer. The charge was to my TD Bank checking account.

Everhome does not carry our mortgage, but I do have a fraudulent charge for $29.95 from Global Web on my account. I just called to notify Wells Fargo and they suggested that I go in as soon as possible to create a new account. There is no point in calling the number as it’s just a scam. They aren’t likely to admit any wrong-doing or refund the money. They think because it’s a relatively small amount it won’t be noticed and they probably get by with it enough to make a fair sum of money. Cash is looking like a better option.

Be aware of this charge. I called the number on that change and they always give me “you will see the refund in next 14 days” which never happen. You call in different date they will give you another +14 days of the date you call. The guy I talked to sound like he has no control over this situation, it’s like they are trying to find money to refund or holding your small amount of money until you forget so they can have it for free.

Call your bank and dispute the charge. Let them know this charge is SCAM. Consider to change your account number as well since they have your bank account number already.

I have Everhome Mortgage but they states nothing wrong on their side.

Found a charge on my aunts bank account 1st of May, Web Global, Entertainment.. called the number and they stated saying that she must have gone on line …. I interrupted them and said, she has dementia for several years and she has NOT gone on line for anything.. they quickly credited her account, and now I found one on mine.. and I called and made them credited mine also, I do have Evermore as my mortgage company, however my aunt home is paid off, so they hit her account because my name is one it.. this is shameful… and not sure who we should contact as a scam..

The fraudsters are going after banking accounts mostly. I had a charge on my Suntrust Bank account for 29.95 for Web World, or Net World. It was either a test or a new type of fraud called cramming. In cramming, the fraudster bills hundreds of thousands of these small transactions and hopes no one notices the charges. The money is probably laundered through collusive merchants, and goes God knows where. I had to close my bank account. They know your name, routing, bank account, and address. DO NOT BE SURPRISED if they have stolen your identity as well. Check your credit at least once a year, change passwords every 3 months, do not make passwords all the same. All of our personal information is out there.

This sounds like it is not your bank’s issue unless they had a security breach. Banks/Credit Unions receive these types of drafts on accounts all of the time. Anyone who has the MICR information on the bottom of your check can produce a check that will clear your account. The bank likely absorbed the $29.95 fee as it is not large enough to go after the company. I’m sure that is what the company is relying on that the banks won’t get enough of these to want to follow up.

Wow this is so insane to learn about! Agree with @Fraud – it’s basic IT practice to make everyone change their passwords every 3 months… got to be safe!

There must have been a hacking of some sort or breach of information in the financial sector. I checked my account today and saw this same charge (29.95 via Global WEB) for a suppose 7/4 2:30 am adult site subscription. Some pervert needed his porn fix I guess. I let Global Web have it and they’re refunding me. its weird but I feel violated. Got to change my acct # now.

So mad! This 29.95 from global web was charged to my account. I clef the company and since they were going to refund my money I didn’t bother calling to dispute it with the bank. Big mistake. I have been waiting for a refund since April 1!!!!! It’s July 16!!!! Everytime I call they say give 14 more days. Now it’s a recording saying your refund is processing!!!! I’m so upset about this.

Great….. now the phone numbers I call all say sorry no one is available and all refunds are due to be processed. Im so mad that these people stole this money from me and from so many others and have pretty much gotten away with it!!!!!

is this global web anything to do with the money transfer outfit Global Web Pay?

Pingback: Site Stats, the Blog, and Whatnot (Mostly Whatnot) | It Takes All Kinds... A Blog by Mark

Just checked my account and I got hit with $29.95 from “G Web Network” on 07/07/14. I called Chase and they said on 03/22/13 I was hit with $29.95 from “Global Web” and can’t dispute either charges because I didn’t claim the first one in time as I didn’t see it or reported it until today. I called G Web and they said the same story “we are the processing agent etc”. G Web said its a montly charge for adult web site so this might be a montly thing now. BTW I also had a mortgage with Everhome, looks like I need to close my Chase account ASAP.

My account was hit again now in July 2014. This time by “G Web Network” for $29.95. It had a fake address (a real street in the same zip code as my bank’s hq address but non-existing number) and the informal version of my first name was used, which I don’t use for my bank account. The makes me think this was harvested from my bank’s Bill Payer service where I would use the informal name for an account. I have multiple accounts with my account and this is the only one with Bill Payer. Furthermore, I haven’t actually used the service since 2010.

I was outside the US the last time it happened and in the end I just got a courtesy credit from the bank. They seem disinterested in pursuing or reporting the fraud, which is irritating.

Happened to me July 17, 2014. Just happened to be going back over my account statements and noticed the charge. Wrong address also. Called the phone number on the memo and got a recorded message saying the refunds were being processed. No live body to talk to. I was told by my bank that this had happened back in March of 2013 also but it would be too late to do anything about that one. I need to go to the bank and fill out a fraudulent withdraw form. Looks like they took a break for a year and then started back up somehow. Hope they get what they deserve soon.

I just had the exact same issue happen to me!! Same charge amount slightly different name. When I called “International High-Tech Consulting” at 877-209-7123 I got the same story “adult website” charge but no more detail. I called Wells Fargo and they have closed my account and are opening a new one. What a pain in the butt. I have never had a mortgage through Everhome so I suspect this is a different data breach.

Unfortunately this is still happening. A similar ACH payment was made from my checking account to “Web Intel Trading, Inc.” for $29.95 on 10/28/14. I also had a mortgage with Everhome until 2013. It seems our information is still out there and circulating. My bank seems to be handling this quickly, but I still have to go through the time and hassle of setting up a new account.

Same thing happed to me, I do not have Everhome, and the draft was made in my old last name (4 years now married) and the companies name is Web Intel Trading $29.95 on 11/7/14. I’ve closed my account and filed a fraudulent claim. I called the number on the draft and they told me the money would be back in my account in 5-7 business days. I don’t believe by seeing all of these comments that I will get my money back.

This same thing happened to me. My checking account was charged $29.95 by ‘G Web Network’ for an adult website subscription. I looked up their website at gwebnetwork.com and called the customer service number listed on the site to complain. No answer, so I left a message. An hour later I received a call from a ‘Ray Case’ calling from a Florida cell phone. He said they would refund my money. I asked how in hell he got my banking information and he wouldn’t answer. The office address listed on the website was in Colorado. I later Googled it and it was a Regus office address, yet no one from Regus ever heard of the company. The website has since been pulled down. This is the info from their site:

G WEB NETWORK

11001 W. 120TH Ave. Suite 400. Broomfield, Colorado 80021.

Toll-Free: 888-493-2364. support@gwebnetwork.com

Also, I copied some verbiage from one of their pages and Googled it. Their entire website was a copy of a legit company in Europe.

These are shady criminals using fake company credentials to steal funds via ACH. I guarantee these clowns did it thousands of people and have disappeared.

My main issue is that my bank in question (a small one) does not seem to care whatsoever and is not doing anything to pursue the matter. I am also convinced that the source of my bank info was through their Bill Pay service, which is actually outsourced. Probably a lot of smaller banks use it.

I have an unauthorized electronic check charge of 29.95 from my account to WEB INTEL TRADING INC. When i called the number on the check, they told me that their computers are down and to call back some other time.

This has happened to me twice, two charges for $29.95, one in July 2014 and one in November 2014. The first was from G Web Network and the second was from Web System Sales. I used to have a mortgage with Everhome, as well.

I have Chase and just received a $29.95 ach from Web Systems Sales, Inc

Thank you for posting this info – we knew it was fraud, seeing your blog affirms I have to close this account and pursue a refund (I know, good luck to me, right ?).

Thank you

Thank you for posting this. I am on the phone with the bank myself. It is such a shame that people can be so selfish and think they have the right to do this. I am flabbergasted and am going to post this on my Facebook as a warning to everyone. Absolutely ridiculous!

Thanks for posting this, I had the same fraudulent activity from WEB INTEL TRADING INC as well, for the amount of $29.95. Very annoying!

They hit my account a third time in late November, but it had been closed for 3 months. Nevertheless, my bank sent me a letter. Will they investigate or pursue the matter? Definitely not.

The first time, the transaction was not reversed, but I got a courtesy credit after complaining. The second time in July, it was reversed. But they still persist and try a third time. I wonder if the thieves have an algorithm whereby after X number of successful attempts they will earmark an account for a big attack and try to withdraw several thousand, or is it just this huge volume of 29.95 hoping that X% sneak by under the radar.

p.s. It seems that SH was also hit in both July and November.

I also was charged $29.95 to my Chase checking account through an ACH check from Web Intel Trading Inc. I called the number on the check 877-209-1723 and was told the charge is for an adult web site and was made in my name on 12/23/14 at 1:23 am. I was told I would receive a refund in 5-7 days and to not have my bank (Chase) issue paperwork for a refund as it could result in a double refund which is fraud. After reading all of the entries from people who had the same thing happen to them, it is funny that this company is worried about fraud. I will be calling my bank on Monday.

Yes take it up with your bank because you will never see a penny from these thieves! We all need to try to bring this to the medias attention, local and or national. I have tried and never get a response; even when I share this blog. These thieves are getting away with tens, if not hundreds of thousands a day! No agency seems to give a big crap. The Secret Service Agency is a joke! There are no agencies who seem to want to take this fleecing of America on. Makes me wonder who all are on the receiving end of this evil little project. If it was a tax scam, the IRS would be all over it now wouldn’t they?

Just found 2 of these, one from November, one from July. According to this post https://forum.419eater.com/forum/viewtopic.php?t=234704 the fraudulent charges trace back through a number of mortgage companies, all of which use Lending Processing Services to process payments. One of the mortgage companies is one I escaped from a couple of years ago . . . but I haven’t changed the bank account. I will now. . . .

Sadly, my bank’s customer service people were not particularly helpful. I’m calling my state’s AG next.

Sally, you can probably get the November check reversed. It actually makes a big difference if it is an ACH or echeck. In the former case there is not really a time limit (even though the bank will deny this) but for an e-check (really it is a “demand draft”) typically 60 days from the statement. For a demand draft the Uniform Commercial Code applies and the bank’s policy for transactions applies.

I also want to make the point that I do not have a mortgage, so my account information must have leaked another way. I suspect the e-billing service that my small bank uses. I have 3 accounts and the one with active e-billing is the one where they got my account details. Alternatively, I have used it for ACH direct payments to CC companies and utilities. However, in the 2 years leading up to the first “hit” in early 2013, I had only used it with two large CC companies.

Yes, my bank will refund the November one (although they want me to call the customer service number prominently displayed on the front of the “check.”) But I really wanted them to acknowledge that there was a security breach. I don’t believe they should have authorized the check at all, and if there isn’t security to protect against faked “biller drafts” then there ought to be. The only electronic payments from the account are the mortgage and the utility bill.

JoAnn here–so I am joining the rest of you and I just checked my Chase account and just had the exact same experience as everyone else–$29.95 taken out of my account on 12/9/14. Supposedly authorized by my son (who is an adult and has his own account and wouldn’t even know mine. We don’t have an Evergreen Mortgage, but clearly this is all problematic. What’s odd for us is that we don’t pay anything “online” we have Medicare and insurance charges taken out monthly. So What a mystery. I’ll call Chase Fraud right now so they know this is happening constantly. Wow

This just happened to me today. I got an e check deposited from my bank account (with my e-signature?) for $29.95 from Web Intel Trading Inc. . The phone number on check is 877-209-7123. I called the phone # listed and they said it was charged at 2:34 am from an online porn company. They said they are just the billing company. I told them to reverse the charge, however, I feel like whomever I spoke with is “in” on this whole fraud thing. The first time I called a woman answered and she said she would reverse the charge and then I got hung up on. So , I called back and then a man answered and I started telling him again what happened and he said it’s been reversed. I said, “wait…how do you know who I am? I never told you..I just called back because I spoke to a woman and it hung up on me..I never told you who I am so how did you look it up?” He got super weird and just said give me your account number…”. I said “why, you obviously already know who I am! This is fraud!” Anyways, he said he would credit me but when I called my bank they said it was impossible for him to reverse it because the check had already posted. There is something very fishy going on here!! Now I have to go to my bank today and close my account and open a whole new account, thus call all the companies I have auto billing with and give them all my new information.

BTW-my lender is Bank of America…i’m not sure who they use for processing…

I did receive my refund from Web Intel, but am still concerned about how they got my bank info in the first place.

This happened to me this morning. There was a $29.95 withdrawal from my US Bank checking account. Like many of you, my mortgage is with Everhome Mortgage. What is sad about this whole situation is that the authorization user was husband – who died ten years ago! So, this is definitely a fraud situation. I am now going through the hassle of closing my account and filing a police report. *SIGH*

Lora,

I have an unauthorized $29.95 electronic check withdrawal that is dated 1/2/15 and posted 1/6/15. It is from BOOST SALES SYSTEMS, INC. Telephone # 877 742-2930. I called my bank to report this fraud and also emailed my bank: Bank of America. I do not have Everhome Mortgage, but I do have Capital One credit cards. I called the number on the check and spoke to “Jeffrey”. He said he works for internet company merchants and they are an Alliance Network….would not give me an address, said he had a satellite office. I asked what the charges were for and he said that at 12:55 a.m. on January 2nd, 2015 I subscribed to an adult website via the internet. I did not subscribe to anything and if I did, I would never use my checking account on the internet. I told him I reported this to my bank and he said he asked me if I wanted to cancel the subscription and receive a refund. I responded I did not subscribe and to give me a refund. He gave me a confirmation number and told me to not have my bank also credit this amount as it would be a duplicate credit and that is fraud…WTH! They are fraudulent, beware!!

I would advise just disputing the transaction with your bank or credit union. You likely won’t receive the refund from the company. At least, that is what I have experienced. As long as you dispute an ACH transaction within 60 days, you’ll receive credit immediately.

I just found this post when searching a charge from web intel trading made on Jan 20. I called the number on the charge and was told they were billing support for an internet processing company and the charge was made at 1:15 am from an adult website. Also for 29.95. I bank with suntrust. We did have a mortgage with Everhome, but that acccount hasn’t been active for nearly 5 years, but we do still have the same checking account..

I just noticed a check charge for $29.95 on my checking account from a “Web Real Services Inc” and there is a phone number on the check 877-751-4026. I have never had a mortgage nor a capital one card and my bank is Wells Fargo. Do you think this could be a related scam? I already reported the charge to my bank.

Well add another one to the list. Same 29.95 electronic check posted to my bank acct. Called the 800 number to get a voice recording of a woman with a foreign accent saying no one there to answer but all refunds were being processed. I went to bank next day and closed checking and started new acct. and signed affidavit for fraud charges. I have read these posts and the only thing I have in common is a Cap One acct albeit a charge acct not a bank acct with Cap One. My question is why aren’t the banks blocking this company across the board to save all customers the incredible amount of time they incur to contact and change all their EFTS in their accounts.

Very similar situation. Web System Sales Inc., $29.95 (issued 01/13/2015, cleared 01/16/2015) from my Chase checking account. Called 866-815-5731 and also received the following automated message (thick foreign accent):

“Hello, you have reached our billing support service. Unfortunately our live support is currently unavailable. All pending refunds are due to be processed soon. We are sorry for the inconvenience.”

Oddly enough, my 9 year old son’s name is the one being “Charged To:”. Had to freeze my Chase checking account. Will have to close and reopen ASAP to prevent overdrafts. Don’t think I’ve ever had an Everhome Mortgage (but who knows seeing how often these banks sell mortgages), and have never had a Capital One account.

I need to read through all of the posts in this thread to see if there is anything I can do or anyone I can contact to assist in bringing these fraudsters down. This kind of activity ticks me off because there are probably THOUSANDS of people who don’t realize they’ve been scammed due to the low amount.

What bothers me even more is that when I spoke with Chase Fraud Prevention yesterday, they didn’t seem to know anything about this scam. You would think if I could find a blog about this on the internet, they could at least have in their “scripts”, key words of 29.95, a list of the companies mentioned (Web Real, Boost Sales Systems, Web Intel, etc.), the phone numbers on the checks, any thing to identify this type of fraud. If there was a little more due diligence on their part, along with the assistance (pooling of information) from other financial institutions, these dirtbags can be caught and the fraud stopped.

Just happened to me… January 2015! But the name is different. It’s now WEB INTEL INC, same $29.95… Froze account, now awaiting the outcome! Idiots used my wife’s maiden name, so it definitely stood out right away! Plus the check number was 7 million+ numbers from my last check number

January 2015: $29.95 charge from Boost Sales Systems to our Wells Fargo Checking. Called the number on the check 877 742-2930 twice – they promised a refund twice but nothing has happened. Called Wells Fargo and they immediately refunded the charges. Will keep watching the account for further charges

We to just had the same thing happen to us twice and we had ever home Mortgage. One charge was from Boost sales system and the other was from Web intel INC. BofA said it is some sort of fraud scam.

That’s just it, it is a fraud scam but the Secret Service is of no help in eliminating this scam. These people know that they can continue to do this and that most people won’t catch it. I have shared this page with the media, but I guess it isn’t a big enough story to air. All I can say is watch your accounts and bring it to your financial institutions attention as quickly as possible; they are the only source that you will get your money back from. If you wait too long, the statute of limitations will eliminate your chance of getting your money back. Good Luck

That is a lot of $29.95 payments. Adds up! I too have been a Everhome Bank customer and have a Capital One credit card. The draft I received was drawn by Web Systems Sales, Inc. and cleared through JPMorganChase. I called the number on the draft, 866 815 5731, and was given a confirmation number and told I would receive a credit within 5 to 10 business days. I also called my bank, Wells Fargo, and was immediately given credit. I checked back with Web Systems days later and got the same message others got that live representatives were not available. Well this has gone long enough. I plan to notify the FBI and the Federal Reserve.

Frank

My charge came under the name of WEB REAL SERVICES, INC. The “Suite” on the address has at least 191 companies registered to that room. Tim Valera and WEB REAL SERVICES were both added to the list in August of last year. Apparently they just register a new name when one gets too clogged with complaints. Next stop: My bank and, I assume, the police station.

My charge also came under the name of Web Real Service and I called the number on the check at Alliance Network (which “Josh” says is a worldwide third party billing service located among other places Miami, FL). I also have a call in to Legalinc Corp Service which is the address listed for the company. $29.95 out of my account, the check says “charged to” a company that hasn’t existed for 3 years and I haven’t worked for for 5 years. I may die trying, but someone’s going down for this!

Happened to me too, closed my 10 year old account and this created a headache of follow up all for such a small charge.. thank God it was on $29.95!

I guess I signed up for this bogus service on 4-7-2015 @ 8:55am under my madden name from six years ago.. ummm NOT!

just got nailed again, had it happen last fall to my checking account AND my 86 year old mothers who NEVER uses internet or any kind of online payments, no debit card nothing! how the F can they get acct numbers like hers???? she mails all her checks.

I only noticed this time as i had to deposit at atm, and the slip showed i was -$53??? went to bank today and sure as hell $29.95 stolen by intl trading whatever… plus overdraft charges! came home and told mom to call bank to make sure they didn’t scam hers again and sure enough!

so basically i was informed all you need is acct & routing info, print a fake check and steal money all day long? no safegards? really????

how many years has this scam been running now? how many millions stolen so far funding terrorist groups no doubt! and it’s still allowed?

This just happened to me for the first time today. Web Real Services, for 29.95. All they could tell me was that it was for a monthly subscription that was set up at 11:03pm last Friday (I was at a birthday party and certainly not signing up for any monthly anything). They will refund they say. This hit my checking account. I do not have capital one or this mortgage company everyone else seems to. Very scary though. Closing my 15 year account and starting from scratch. ;/

Reporting another case. I too had Everhome mortgage. Just found out I was charged $29.95 3 times, 1st time in March 2013, 2nd time in Oct 2014, 3rd time in Apr 2015. only found out today when I saw a check # that’s 6 digits. I thought hmm that was interesting, all my check #s are 3 digits. Called my bank and turned out this has been going on for 2 years!!

Just had this happen to me today. My bank is taking care of it. Crazy this has been going on for so long!

Web Real Services Inc, was the company my bank paid $29.95 on behalf of my madden name from almost six years ago. It was an electronic check, with a different number series that caught my attention and the fact that they used my old last name had be baffled! The telephone number 877-751-4026 connected me with a woman who was helpful in advising she didn’t know any specific info either, that she was pretty much a third party. She did say that she cancelled the subscription but could not advise for what.

Had to get a new account, reset all my payee accounts and a bunch of other annoying things because of these a-holes.. All I can day is thank God it was only for $29.95!

Interesting, I to have a Capital One 360 account I have not used since I was married, hummmm maybe that is where this all stemmed from….

Web Real Services unauthorized debit for $29.95. The woman at 877-781-4026 reversed the charge, said she was a third party biller. I am in the process of closing my bank account and opening a new one. They had an email address for me that was never my email address but was a plausible combination of my names. I don’t have connection to Everhome or Resource Express Lenders or a Capital One 360 account.

Same story…29.95 check posted to my Bank of America business account 4/27. Strange looking check…called the number on the check and said it was for a monthly subscription to a website. I never signed up for that! Said they would refund in 5-14 days and close my account. When I called BofA they reported the check fraud and now I have to close the account and open an new one. I use this account to pay bills on line.not anymore! What a headache!

By the way, they are now operating under Free Multi Sales, Inc.

They are operating as New Sales & Services Inc, phone # 866-311-0818. Looks they replicated bill pay checks from BOFA

I also got hit with a transaction under the same business name: New Sales & Services Inc, phone # 866-311-0818

My old theory was that they got the bank account numbers from the third party service that handles “bill pay” and “e-check” service. The one account of the three that I have with a small bank that they hit was set up with this bill pay service. It is handled by a third party that mails checks and it is likely that many banks use this service. With BOA you might expect them to have their own operation, but this is something that is more efficient when outsourced.

Pay To: Top Web Services Inc; 877-753-6347; $29.95 posted to Regions Bank on 4/27 at 1:46 am CST. I called the phone number on the electronic check image, and a lady stated that the charge was for “a subscription”. I told her that I was going to contact my bank regarding fraudulent activity; she agreed (strange). She then advised that she had “reversed” the charge, deleted all of my information, and that I should see a refund within 2-days and provided a refund number…without any hesitation (strange). I was also with Everhome Mortgage, until they sold my loan just last year. Advice from the bank….close this account and open a new one, because this company has access to your routing and account numbers.

They have another name too. Mine was processed under New Web Sales Inc. They got me on 5/8/15. The charge was “authorized at 1:50 a.m on 05/04/15 IAO 29.95. I was asleep at that time. I work for my money. They just told me it was an alliance group who does internet billing.

Same thing happened to me I am surprised as to how long this scam has been going on.

Mine appeared as Web Access Services or something like that echeck for 29.95.

My bank’s agent called and we had a 3 way call where they agreed, no questions asked to refund the money. This appears to me a part of the scam to make it look more legit, those that call get the money back those that don’t…too bad.

My agent said the billing company is most certainly part of the scam and to file a claim with the bank anyway as well as report them to State Attorney General’s office so they can investigate. He said he watched millions of authorized charges being returned by court order in the past after AG investigates these types of scams.

Funny thing is they misspelled my name the same way that Landover mortgage did many years ago so this is almost certainly breach of security probably by an ex-employee or such who is steadily milking old stolen or hacked data…

Well, I am considering a career change nowadays maybe I should go to information security field and hunt beasts like these. They seem to be multiplying quickly everywhere.

Meant to say millions of Unauthorized charges.

’ve been hit twice by them now, and what’s so scary is my bank seems to think they’re a legitimate business. One of the bank employees called the number on the ACH “check” and was told by a live rep that it was for a “description” (I assume she meant “subscription”) and she would do a one-time courtesy refund. She also advised the bank employee (who was acting on my behalf) that she shouldn’t get the bank involved because it might result in my being refunded twice. If that doesn’t raise some red flags, I don’t know what would!

I don’t have a mortgage through Everhome and my debits came through as “Web Sales Management Inc” and have my husband’s name referenced on the check. There is an 877 number for inquiries.

I was just scammed by boost sales for 29.95 and I also use Everhome Mortgage

A brilliant scheme that has apparently made life uncomfortable for many. I was charged 29.95 for a monthly subscription for a web service. In the process of closing current account. Fraud alert has been initiated. We need to figure how to catch these bastards! There has to be a way to give them a taste of their medicine.

I was also a victim of this scam. A $29.95 check was posted in my account this morning. I have already been to my bank and opened an investigation. I closed current account.

My charge was something called Top Web Services

I fraudulent check cleared my checking account with Wells Fargo this morning for $29.95 with a Pay To The Order Of: Free Multi Sales Inc. I contacted Wells fargo fraud division and froze my account.

I just noticed a $29.95 check clearing my account on 6/8/2015. I called my bank and was told the charge is from Top Web Services Inc (phone 877-753-6347) I will be calling Top Web hoping they reverse this charge and after reading all the comments will be calling my bank to open a new account.

Just an update. When you contact your bank, make sure you get the TR ID# beginning with 17….TOP WEB SERVICES INC will need this number to look up the transaction. TOP WEB said it was a subscription order that was placed online. I advised TOP WEB that I did not order any subscription on line. They immediately cancelled the transaction and provided a confirmation number to refund my bank account. They said they would delete my information from their system, but better safe to close existing account.

I just received the same $29.95 debit from my account, from TOP WEB SERVICES INC. Funny thing is… it was my savings account and I have no debit card, checks, or monthly drafts linked to this account, just a true savings account, only accessed by me at the bank. Called my bank to dispute, then called the 877 number on the draft form. They were worthless, not even a party to the transaction, just a “receipt holder” named BILLING SOLUTIONS. They could not tell me who, where, or contact info for TOP WEB SERVICES INC. They did however give me an IP address and a FALSE email address that was “used for verification”. Seriously amazing how easy it is to commit bank fraud, and how hard it is to dispute it. Not sure how my account number was obtained as it is a savings account not linked to anything, and never used for anything online.

I would not call the company to reverse the charges. It is like catching a burglar and letting him return what he has stolen and not call the cops. If you report the transaction as fraudulent (which it was) then your bank will refund it; there is at least a record of a fraudulent transaction and we hope that at some point these guys will be stopped. This is a hassle, but you should change your account number anyway, so just do it in the same process.

Total Web Services got me and I don’t have Everhome Mortgage. It looks like they keep running the same scam and just change the company name.

I just reported this to the FBI internet crime department at http://www.ic3.gov.

It’s disturbing that someone can set an unauthorized ACH transfer so easily. According to my bank all they need is the information they can get off your check. It sounds like banks need to add an extra level of security so this won’t be possible. It would save them time cleaning it up and would save the account holder the hassle of having to get new checks and set up all their ACH payments, but it probably won’t happen because it makes too much sense.

The banks will tell you that if they restrict it then you can’t make online ACH payments to pay bills, etc. However, some companies send two micro payments to your account and then you have to confirm the amount before authorizing future ACH transfers. Paypal does this, as well as my online broker. None of my credit cards or utilities bother doing this. It should be made compulsory by the banks.

I agree with DW and FLR: currently it’s just way too easy to get a fraudulent echeck cashed by your bank. Banks can and must do more to protect the money entrusted to them by their customers; the method described by FLR is one the banks can use, there probably are others. If banks don’t want to do it on their own then maybe we need to start a public outcry for new regulations. Thanks to DW and FDR for their postings.

CHECK# 4486507 $31.63

PAYABLE TO: NEW WEB TRADING INC.